Covid-19 – 2008 Housing Tips

First and foremost, we hope you and your family are safe and healthy during this time of quarantine and social distancing, please continue to observe the safe practices as recommended and look forward to hear from you again.

Many people are confused and asks us about the Covid-19 situation and real estate, as understandable,

I summarized in practical terms the info below, feel free to look at the short video if you prefer and analyze these charts.

let’s look at five things we know about today’s housing market that were different in 2008 and some Covid-19 – 2008 Housing Tips.

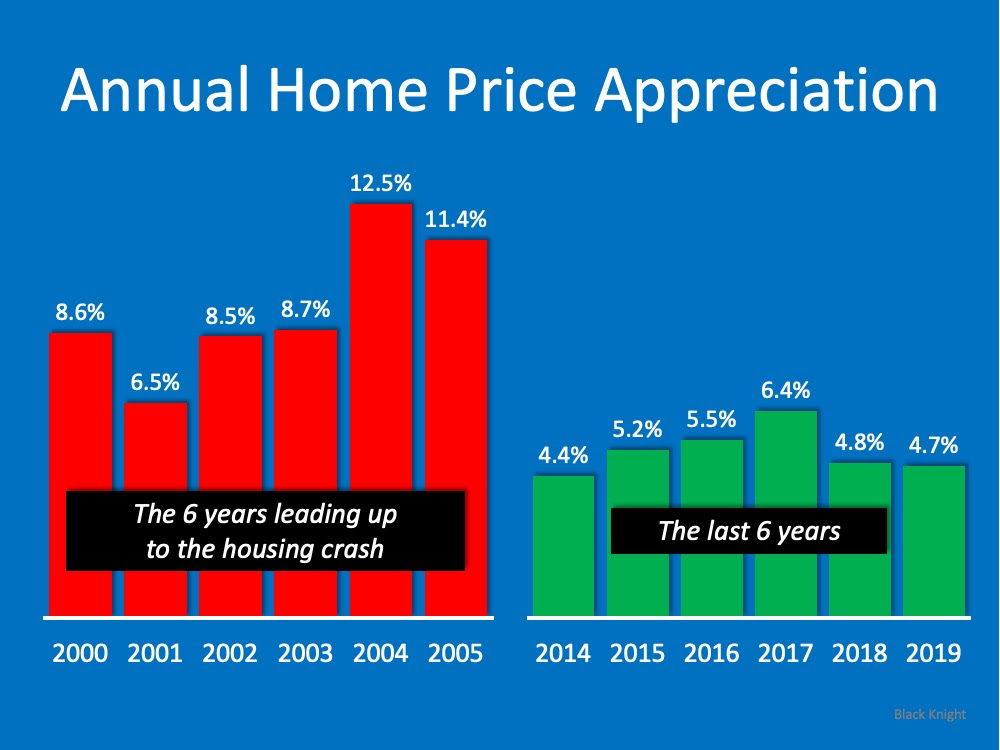

1. Appreciation

When we look at appreciation in the visual below, there’s a big difference between the 6 years prior to the housing crash and the most recent 6-year period of time. Leading up to the crash, we had much higher appreciation in this country than we see today. In fact, the highest level of appreciation most recently is below the lowest level we saw leading up to the crash. Prices have been rising lately, but not at the rate they were climbing back when we had runaway appreciation.

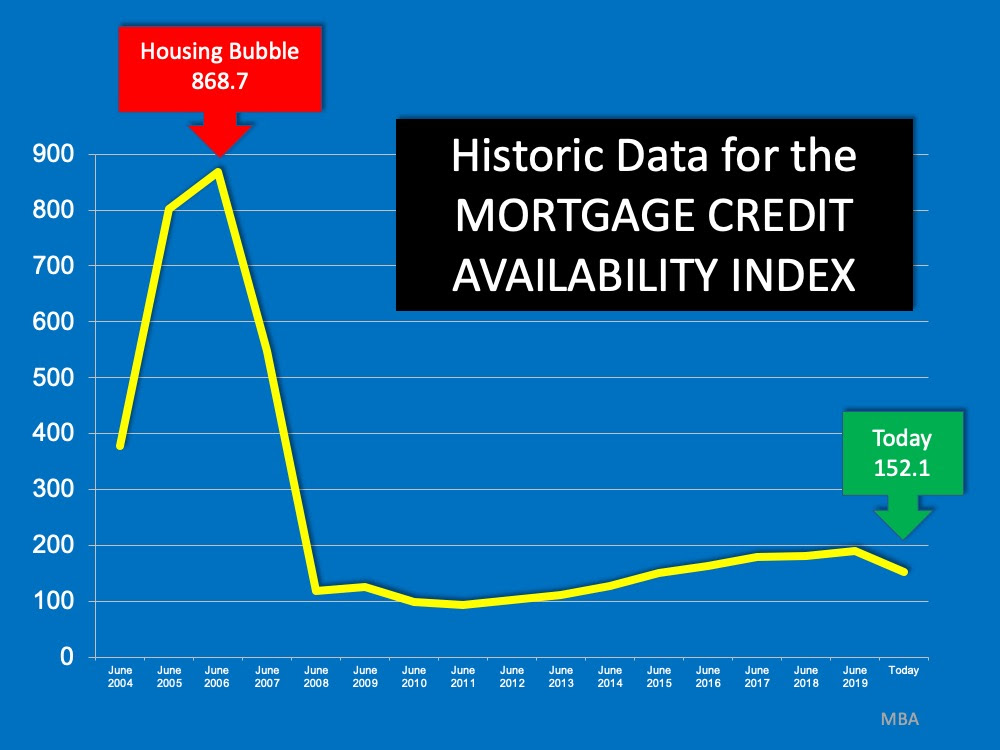

2. Mortgage Credit

The Mortgage Credit Availability Index is a monthly measure by the Mortgage Bankers Association that gauges the level of difficulty to secure a loan. The higher the index, the easier it is to get a loan; the lower the index, the harder. Today we’re nowhere near the levels seen before the housing crash when it was very easy to get approved for a mortgage. After the crash, however, lending standards tightened and have remained that way leading up to today.

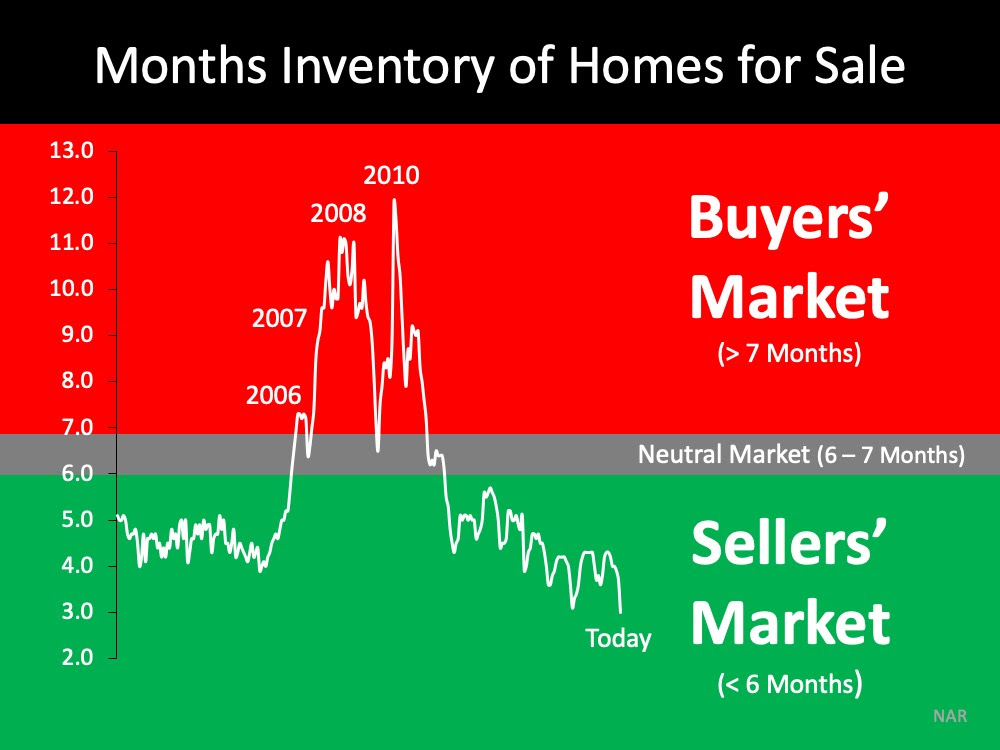

3. Number of Homes for Sale

One of the causes of the housing crash in 2008 was an oversupply of homes for sale. Today, as shown in the next image, we see a much different picture. We don’t have enough homes on the market for the number of people who want to buy them. Across the country, we have less than 6 months of inventory, an undersupply of homes available for interested buyers.

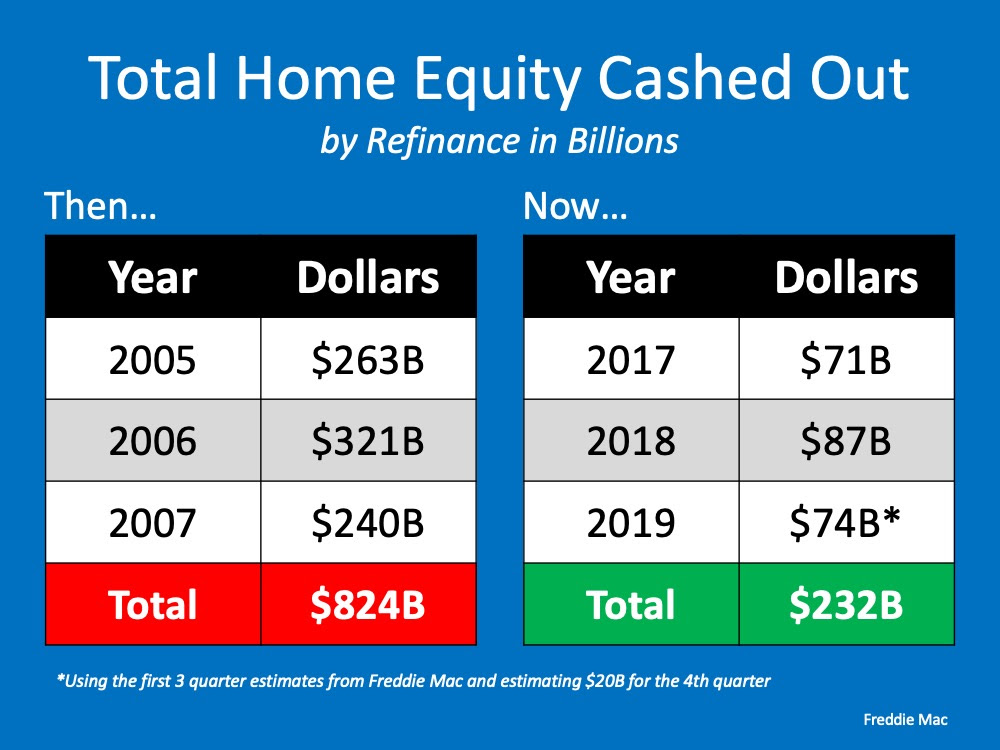

4. Use of Home Equity

The chart below shows the difference in how people are accessing the equity in their homes today as compared to 2008. In 2008, consumers were harvesting equity from their homes (through cash-out refinances) and using it to finance their lifestyles. Today, consumers are treating the equity in their homes much more cautiously.

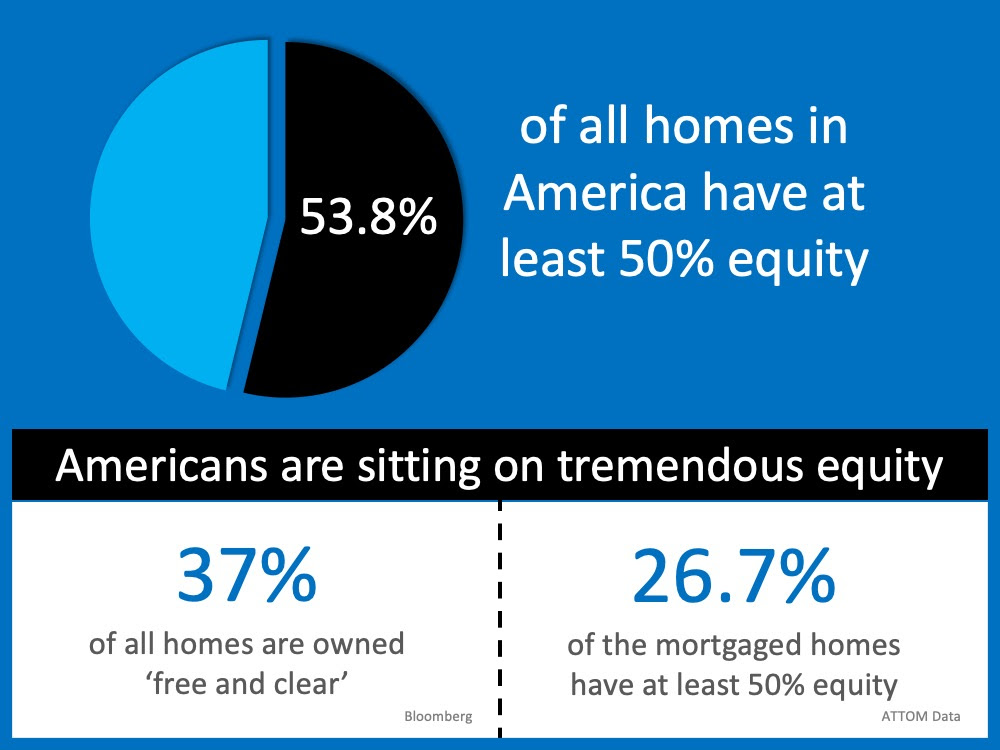

5. Home Equity Today

Today, 53.8% of homes across the country have at least 50% equity. In 2008, homeowners walked away when they owed more than what their homes were worth. With the equity homeowners have now, they’re much less likely to walk away from their homes.

Check these comments:

The COVID-19 crisis is causing different challenges across the country than the ones we faced in 2008. Back then, we had a housing crisis; today, we face a health crisis. What we know now is that housing is in a much stronger position today than it was in 2008. It is no longer the center of the economic slowdown. Rather, it could be just what helps pull us out of the downturn.

The Covid-19 situation have brought about many unknown variables and is not yet clear how this health crisis might affect the economy/financial environment as a whole, according to some of the local real estate experts there might be some variables to look at as the following months unveil how our lives will return to some degree of normalcy and they believe there might be some impact in the local Northern-NJ market., more info to come as it might be available, stay tuned.

Do You Know What's Your Home Value?This is the Best Possible Time to Sell if Thinking to Move.